will capital gains tax rate change in 2021

You will be taxed at your ordinary income tax rate on short-term capital gains. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er.

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Say your AMT tax comes out higher than ordinary tax in this situation you will have to comply with two tax rates 26 and 28.

. Capital Gains Tax Rate 2021. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Lets say a couples total taxable income from working a job and capital gains is 83000.

The tables below show marginal tax rates. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. The couple could pay 0 on profits for stocks held over a year if they are married filing jointly.

Tax brackets change slightly from year to year as the cost of living increases. The tax rate on most net capital gain is no higher than 15 for most individuals. The IRS allows you to claim an exemption in this scenario.

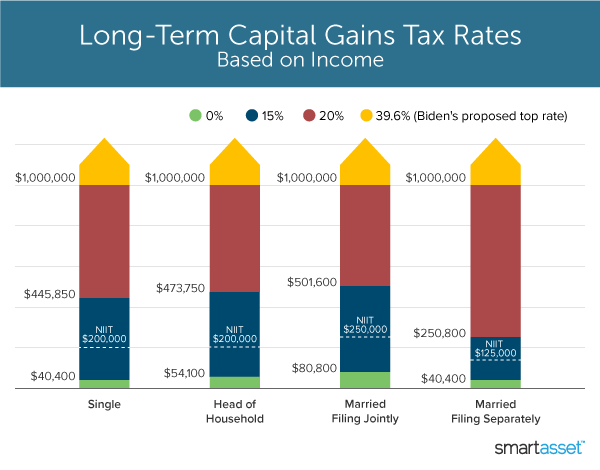

Another would raise the capital gains tax rate to 396 for taxpayers. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. On June 30 2021 Governor Mike DeWine signed 2021 Ohio Substitute House Bill 110 HB 110 which is Ohios biennial budget legislation.

For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. What is the capital gains tax rate for 2021 UK. Gains realized after that date would be taxed at a.

Below you can find the 2022 short-term capital gains tax brackets. Will capital gains change in 2021. There is a change on the horizon which can take place as soon as 2022.

House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. 13 2021 and will also apply to Qualified Dividends. As a result the short-term capital gains rates for 2022 look slightly different than those for 2021.

Under the current proposal gains realized prior to Sept. Historically capital gains tax has sat around 20. This new rate will be effective for sales that occur on or after Sept.

HB 110 includes numerous tax changes such as 1 reducing individual income tax rates 2 extending a temporary rule. Currently the capital gains tax rate for wealthy investors sits at 20. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy. Long-term capital gains are. 13 will be taxed at top rate of 20.

If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Joe Biden says this tax increase funds a 18 trillion dollar. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. If your income was between 0 and 40400. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

If your income was 445850 or more. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. One of the proposals Congress is considering sets the top rate for taxing capital gains at 25 up from 20 under current law.

There are exceptions to this such as when it was 15 from 2004 to 2012. The rates do not stop there. The proposal is bumping this up to 396.

This tax change is targeted to fund a 18 trillion American Families Plan. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. 2021 long-term capital gains tax brackets.

Here are the 2022 and 2021 capital gains rates. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. When the NIIT is added in this rate jumps to 434.

Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. Short-term gains are taxed as ordinary income.

If your income was between 40001 and 445850. Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. For investors who make 1 million or more who are already taxed a surtax on investment income this change could mean their federal tax responsibility could be as high as 434.

Ohio enacts tax changes including individual rate reductions excluding certain capital gains from income. Additionally a section 1250 gain the portion of a. For 2022 you can file a claim for taxable income exemption on AMT for income of up to.

2022 long-term capital gains tax brackets. The maximum capital gains are taxed would also increase from 20 to 25. 7 rows 2021 federal capital gains tax rates.

2022 And 2021 Capital Gains Tax Rates Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains And Dividend Tax Rates For 2021 2022 Wsj

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Definition 2021 Tax Rates And Examples

2022 And 2021 Capital Gains Tax Rates Smartasset

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Tax What Is It When Do You Pay It

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Definition 2021 Tax Rates And Examples

2021 Capital Gains Tax Rates By State Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains And Dividend Tax Rates For 2021 2022 Wsj

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)